Servicios online

Reference Material - Advance Pricing Arrangement (APA)

What's this?

- What is an Advance Pricing Arrangement (APA)?

- Types of APA

- Advantages of entering into an APA

- Legal certainty regarding the outcomes achieved for taxpayers.

- Greater supply and exchange of information between the parties.

- Validation of the indicated valuation methods.

- Validation of the comparables used.

- Economisation of resources, means, and time for the Servicio de Impuestos Internos.

- Certainty granted to taxpayers once they have been approved (bilateral and multilateral arrangements). On the other hand, the tax administration can obtain a certain level of certainty regarding tax collection.

- The absence of transfer pricing adjustments during the validity of the APA helps to predict the costs and expenses of enterprises more securely, resulting in better profitability of their investments.

- Statistics (Update as of December 2025)

An APA is an arrangement that sets, in advance of transactions between related enterprises, a set of criteria for the determination of the transfer pricing for those transactions over a fixed period of time.

In Chile, Number 7 of Article 41 E of the Income Tax Law, contained in Article 1 of Decree-Law No. 824 of 1974, contemplates the possibility for taxpayers engaged in cross-border transactions with related parties abroad to propose an APA to the Servicio de Impuestos Internos (Chilean tax authority - SII), through which the arm's length price, value, or return is determined and agreed in advance for the transactions to be carried out over a determined period of time.

This arrangement must be signed by the representative(s) of the taxpayer, the Servicio de Impuestos Internos and, when it concerns the import of goods, it must also be signed by the Servicio Nacional de Aduanas (National Customs Service), and other tax administration(s), when applicable.

Unilateral APA: Is the one entered into by a taxpayer and the tax administration of a country where it is subject to taxes.

Bilateral APA: Is the one that involves three parties: the taxpayer (including its related party), the tax administration of the country of origin, and the tax administration of the jurisdiction where its related party is subject to tax.

Multilateral APA: Is the arrangement between taxpayers and the tax administration of their country of residence and more than one foreign tax administration.

The Servicio de Impuestos Internos (SII) hereby presents a set of

consolidated

statistics on Advance Pricing Arrangement (APAs), with the aim of

enhancing

transparency regarding the evolution, scope, and processing status of

this

preventive instrument, which is key to providing legal and tax certainty

to

taxpayers and to strengthening cooperation between tax

administrations.

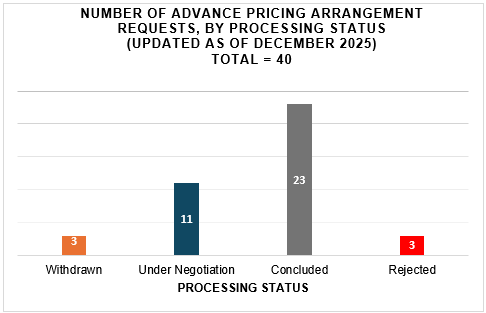

Since the entry into force of Article 41 E of the Income Tax Law in 2012

and

up to December 2025, the SII has received a total of 40 APA requests.

These

requests are classified according to their nature (unilateral,

bilateral,

or renewal), their procedural status, and the existence of import

transactions,

which require the joint participation of the National Customs Service.

In

addition, the figures presented distinguish between the historical total

of

requests received and their current processing status, thereby allowing

the

identification of both the annual inflow of new requests and the stock

of

cases under negotiation or in force.

This first chart provides a detailed breakdown of the procedural status

of

APA requests received by the SII. It includes APAs concluded, requests

under

negotiation, requests rejected, and requests withdrawn, offering a

comprehensive

overview of the life cycle of this preventive instrument.

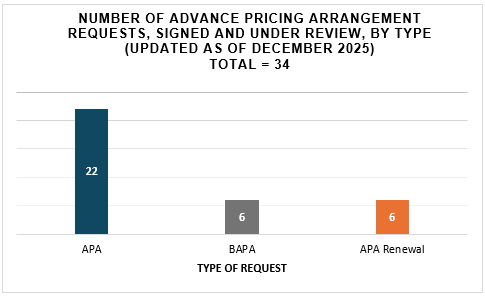

The second chart presents the distribution of Advance Pricing Arrangement (APA) requests received by the Servicio de Impuestos Internos (SII), classified according to their nature: unilateral APAs, bilateral APAs (BAPAs), and renewals of unilateral APAs. The data include only admissible requests, excluding those that were rejected or withdrawn, thereby providing an accurate depiction of the effective use of this preventive instrument by taxpayers.

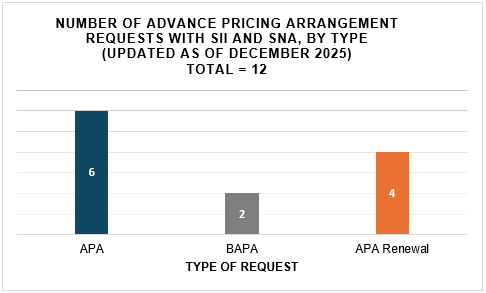

The third chart illustrates the proportion of Advance Pricing Arrangement (APA) requests that involve import transactions, which require joint negotiation and conclusion by the Servicio de Impuestos Internos (SII) and the Servicio Nacional de Aduanas. The data highlight the relevance of cross-border trade within the APAs requested and underscore the importance of inter-institutional coordination in the administration of these instruments.

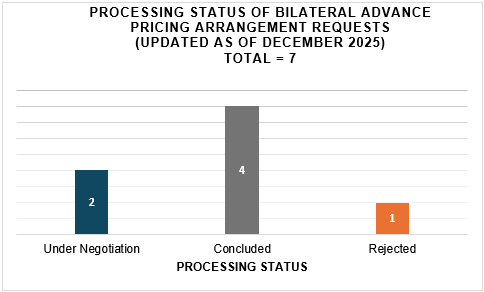

The fourth chart presents the procedural status of Bilateral Advance Pricing Arrangement (BAPA) requests, distinguishing between concluded Arrangement, requests under negotiation, and rejected requests. The jurisdictions involved in these bilateral requests include Canada, the United Kingdom, Switzerland, and the United States.

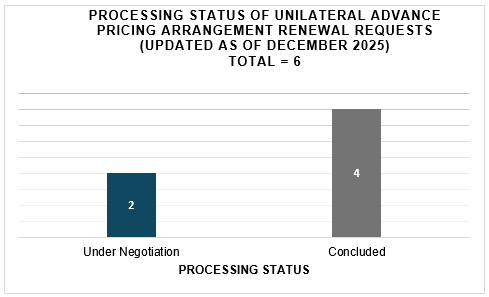

This chart presents the procedural status of renewal requests for unilateral Advance Pricing Agreements (APAs), distinguishing between concluded agreements and requests under negotiation. The information reflects the recurrent use of this instrument by taxpayers and the level of confidence generated in the APA mechanism. With respect to the six unilateral APA renewal requests received, four agreements have been concluded, while the remaining two requests are currently under negotiation, in which the Servicio Nacional de Aduanas is involved.

Evolution of Advance Pricing Arrangement (APA)

Requests

The strengthening of the Advance Pricing Arrangement (APA) programme in Chile reflects a sustained institutional strategy, which includes the establishment of a specialised technical team, the active promotion of the instrument, the implementation of document management systems, and alignment with international standards promoted by the Organisation for Economic Co-operation and Development (OECD), in particular those arising from BEPS Action 14.

The table below shows the number of requests submitted by type of Advance Pricing Arrangement:

APA Requests Received, by Type of Arrangement

| Type of Arrangement | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Unilateral APA | 4 | 3 | 5 | 5 | 3 |

| Bilateral APA (BAPA) | 1 | 3 | 0 | 1 | 1 |

| APA Renewal | 0 | 0 | 2 | 3 | 0 |

| Total | 5 | 6 | 7 | 9 | 4 |

From the table above, it can be observed that 31 out of the 40 APA

requests

submitted to the Servicio de Impuestos Internos (SII) were received over

the last six years. This represents a significant shift compared to

earlier

periods, during which an average of at least one request per year was

recorded

following the implementation of paragraph 7 of Article 41 E of the

Income

Tax Law.

In addition, 2024 stands out as one of the most productive years to date

in

terms of the number of Arrangement concluded. This trend is further

supported

by the increase in renewal requests, which reflects the confidence and

transparency

generated by these Arrangement among taxpayers and the Tax

Authority.

Based on the information available to date, more than 55% of the

requests

submitted have resulted in the conclusion of an Arrangement,

underscoring

the effectiveness of the APA programme as a preventive dispute

resolution

mechanism.

Finally, while the majority of requests have historically been

unilateral

APAs, bilateral requests are expected to gain greater relevance in the

coming

years, given that Chile has 37 tax treaties in force for the avoidance

of

double taxation, including the most recent treaty with the United

States.

These treaties enable the negotiation and conclusion of Bilateral

Advance

Pricing Arrangement (BAPAs), which constitute a highly effective tool

for

preventing economic double taxation.